Hello, fellow drunk monkey traders!

Let’s ChatGPT about a concept that you’ll hear from me often: Situational Fluency. Or as DALL·E 2 imagines it – Sititational Fluenccy. 🤷 (Reminds me of this scene from Night Shift.) 😜

This isn’t about academic theories or complex jargon. It’s about the real-world skill of seeing the Matrix underneath ever-changing markets.

Achieving Situational Fluency is about immersion and observation. It’s spending time with the markets, watching the dance of price patterns under various conditions, and learning to recognize the recurring themes. This fluency comes from experience, from seeing the market in its many moods and learning to interpret its language.

But Situational Fluency isn’t just about being flexible. It also requires a certain steadiness. Knowing when to adapt and when to stand firm is part of the skill. It’s about finding balance in the midst of the market’s unpredictability.

In terms of practical tools, volatility and volume are key indicators to guide us. They help us understand the current “situation” and navigate our trading day with more confidence.

Enhancing Your Situational Fluency: Practical Tips for Traders

Situational Fluency in trading is about more than just understanding market dynamics; it’s about developing a deep, intuitive connection with the market’s ever-changing nature. Here are some specific strategies to help you become more fluent in the language of the markets:

1. Maintain a Comprehensive Trading Journal

A trading journal is an invaluable tool for any trader aiming to achieve Situational Fluency. But it’s not just about logging numbers. Include both quantitative and qualitative data in your journal. Track your performance across different market conditions, and reflect on your thoughts, emotions, and actions for each trade, especially the ones that didn’t go as planned. This introspection can provide profound insights into your trading psyche and strategy effectiveness.

2. Establish a Pre-Trading Routine and Checklist

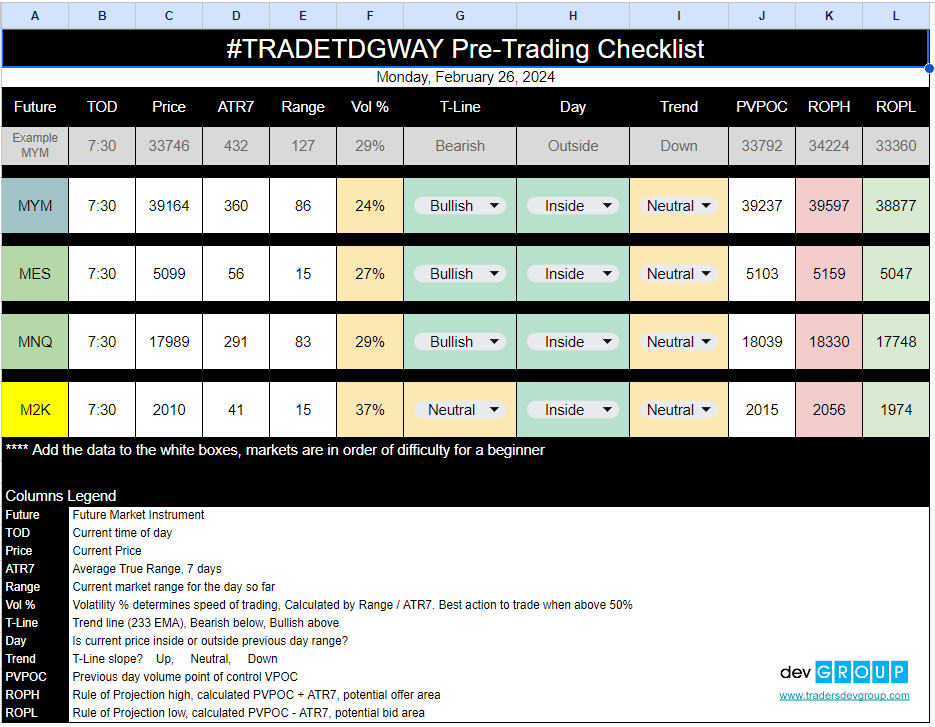

Before diving into the day’s trading, have a routine in place to assess market conditions. This isn’t about setting a rigid trading plan; it’s about preparing yourself to adapt to the market’s current state. Use a checklist to evaluate key indicators and set your strategy for the day. This approach keeps you grounded and focused, ready to make informed decisions based on the market’s present behavior.

Here is an example of the checklist we use in our futures day-trading live stream.

3. Stick to a Consistent Trading Schedule

Consistency is key in many aspects of life, and trading is no exception. By trading during the same market session each day, you’ll become more attuned to the specific patterns and tendencies that characterize that time frame. This consistency helps in developing a rhythm and a deeper understanding of market behaviors during your chosen trading hours.

4. Embrace Market Uncertainty

One of the core aspects of Situational Fluency is accepting that market direction is inherently unpredictable. Instead of trying to forecast the market’s next move, focus on understanding probabilities and managing risk. This mindset shift allows you to remain flexible and responsive to whatever the market throws your way.

5. Recognize the Value of Being Flat

Remember, not trading is also a strategic decision. Situational Fluency involves recognizing when the market conditions are not conducive to your strategy and having the discipline to stay out. Being flat is a position in itself, one that can often be more beneficial than engaging in uncertain market conditions.

Take Your Trading to the Next Level

Interested in seeing these principles in action? Join us for a free trial of the TDG ProTrading Room.

Experience firsthand how hundreds of futures day traders collaborate, share insights, and refine their strategies to enhance their Situational Fluency. It’s an opportunity to learn from a community of like-minded individuals all striving to navigate the markets more effectively.

Trade Like You Mean It!

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.