If you’re trading multiple funded futures accounts, a trade copier can be the missing link between your strategy and your scalability. In this post, I’ll cover why I use Replikanto, how I structure my replication groups, and compare it with other tools like Affordable Indicators, ETP, and built-in copiers from Quantower, Tradovate, and more.

Note: This article is specific to futures trading and the prop firms I discuss on my site and YouTube channel. There are many copiers available for FX and CFD platforms, but those are not part of this discussion. Similarly, this is not about trade signal copying from services like eToro, ZuluTrade, or Collective2.

🧠 Why Use a Trade Copier?

Trade copiers allow you to:

-

Trade from one lead account

-

Automatically mirror trades to other accounts

-

Scale consistently without introducing new decisions or risk exposure

Done right, copying amplifies your process, not your pressure. This concept is often introduced in advanced modules of a futures trading course, where traders learn how replication can simplify execution across multiple accounts. The same principles apply whether you manage a single evaluation or trade across several remote prop trading firms.

🛠️ Why I Use Replikanto

Replikanto was first to market and continues to evolve quickly. It integrates directly with NinjaTrader 8 as a plugin, letting me manage everything from inside the platform.

Key features I rely on:

-

Native NinjaTrader operation (no extra dashboard)

-

Network/Remote mode for VPN-based replication

-

Simple replication group creation by size/instrument

-

Visual sync status and order error alerts

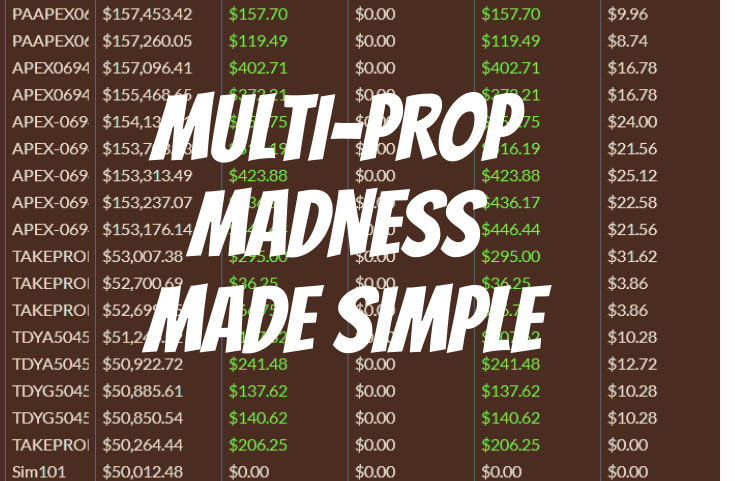

I typically trade MES into a $50K replication group, then replicate that logic for MNQ, MYM, etc. Evaluation accounts act as “scouts” to probe market structure before I bring funded or live accounts into the mix. No ATMs, just simple execution with stops/targets managed manually. Replikanto is powerful — but requires solid NinjaTrader fluency.

📌 I run Replikanto only while trading and never for automation or passive sessions.

This approach is ideal for anyone running funded accounts across futures swing trading prop firms, where order accuracy and timing are crucial.

⚙️ What About Affordable Indicators?

This is another NinjaTrader-native copier and a strong alternative. Many traders in the community prefer its interface and execution style. If you’re focused purely on NinjaTrader-based replication and want a different feel from Replikanto, it’s worth testing. Some remote prop trading firms even list this tool as an approved solution for multi-account management.

🧩 A Note on Apex Trader Funding’s Copier

Apex offers a copier for traders, but it’s a white-label version of Replikanto. If you’re serious about long-term multi-prop usage across firms, I recommend going straight to the source and buying Replikanto directly for access to the full suite of features and updates. For traders exploring what is a funded trading account is, Apex’s structure offers a good example of how copying tools can be applied across evaluation and live setups.

🔄 Other Copier Tools Worth Knowing

Here are some alternative trade copiers and how they compare:

✅ Built-In Options

-

Tradovate Account Grouping – Easiest path for beginners at one firm.

-

Quantower – Allows multiple Rithmic logins, making it viable for multi-prop.

-

ProjectX – Built-in replication; best for accounts within ProjectX.

-

Volumetrica – Excellent for internal trade copying; not multi-prop focused.

🔌 External or Platform-Agnostic Options

-

ETP (Expert Trader Programmers) – Useful for copying across multiple Rithmic-based props (which NinjaTrader limits). See prop firms including The Futures Desk and Prop Shop Trader currently offer a license to ETP with most evaluations.

-

TradeSyncer – A browser-based copier that supports various platforms and brokers.

If you’ve completed a futures trading course, you’ll likely recognize these setups as part of scaling strategies across best remote prop trading firms. Understanding copier compatibility helps you match the right tool to your funded or evaluation accounts.

📊 Trade Copier Comparison Matrix

Use this quick-glance chart inside Elementor with a Table widget or custom layout:

| Tool | Best For | Platform | Multi-Prop Support | In-Platform Integration |

|---|---|---|---|---|

| Replikanto | Multi-prop via NinjaTrader | NinjaTrader 8 | ✅ Yes | ✅ Yes |

| Affordable Indicators | Ninja-based copying, strong UI | NinjaTrader 8 | ✅ Yes | ✅ Yes |

| ETP Copier | Rithmic-only prop copying | External | ✅ Yes | ❌ No |

| Quantower | Multi-Rithmic login setups | Quantower | ✅ Yes | ✅ Yes |

| Tradovate Grouping | Same-firm beginners (e.g., TopstepX) | Tradovate | ❌ No | ✅ Yes |

| ProjectX | Internal use only | ProjectX | ❌ No | ✅ Yes |

| Volumetrica | Internal replication | Volumetrica | ❌ No | ✅ Yes |

| TradeSyncer | Multi-platform, browser-managed copying | Web/External | ✅ Yes | ❌ No |

🚦 Best Practices Before You Copy

-

Start small. Use a couple of accounts to get comfortable.

-

Only copy what’s working. Copying a bad strategy just makes the problem bigger.

-

Watch for firm rules. Not all firms allow copying (e.g., Bulenox), and many restrict news trading or scaling behavior.

A futures trading course often emphasizes risk control and disciplined scaling, both critical before expanding across remote prop trading firms. Remember, copying multiplies both profit and error if not managed properly.

⚠️ Risks and What to Avoid

The biggest risk isn’t technical; it’s psychological and strategic.

Don’t start copying until you have a strategy and risk discipline you trust.

Copying amplifies whatever you’re doing, good or bad.

Also, know the rules at each prop firm. Some (like Bulenox) don’t allow copying or multi-prop setups. Others restrict news trading, require consistency, or monitor for excessive syncing.

Lorem ipsum dolor sit amet, consectetur adipiscing elit. Ut elit tellus, luctus nec ullamcorper mattis, pulvinar dapibus leo.

1. What is a funded trading account, and how does it work in futures trading?

2. How can a futures trading course improve copier-based strategies?

3. Which are the best remote prop trading firms for futures traders using copiers?

💬 Final Thoughts

The best setup to learn multi-propping today is:

NinjaTrader + Replikanto + Tradovate-supported prop firms.

If you’re just getting started with trade copying, tools like ProjectX or Tradovate Grouping let you practice safely within a single firm. But once you’re ready to scale and mix funded + live accounts, Replikanto is the most flexible and powerful solution I’ve found.

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.