Let’s get straight to it: If you want to unf*ck your future and actually succeed in trading futures (or any financial instrument), all you have to do is not lose a lot of money in any given trading session. That’s it. Really.

Warren Buffett’s rules apply here:

-

Don’t lose money.

-

See Rule #1.

Yet, for some reason, traders insist on making this harder than it needs to be.

The Myths That Keep You Broke

-

Candlestick patterns? Bullshit. A candle pattern alone isn’t a signal. Context matters, but most people don’t have a framework to interpret it properly.

-

Fibonacci? Bullshit. If enough people believe in it, sure, but it’s not some magic force moving the market.

-

Trading psychology? Mostly bullshit. The exception: If you consistently blow past your daily risk budget, you are doomed. No amount of affirmations or deep breathing will save you if you can’t stop yourself from overtrading.

-

Trading books? Bullshit. Some are good reads, but it’s like reading about skiing—doesn’t mean you can actually do it when you hit the slopes.

-

Bots? Bullshit. If you think an automated system will print you money without understanding why it works, you’re just donating to the markets.

-

Signal software? Bullshit. If these services actually worked, they wouldn’t be selling them to you.

-

Secret trading methods? Absolute bullshit. If someone is selling you an exclusive, proprietary trading method that guarantees success, run. If it actually worked, they wouldn’t need to sell it.

-

Social media traders? Mostly bullshit. Be careful who you follow. Many show cherry-picked wins and hide the losses, giving a false sense of how easy trading is.

-

Risk-free strategies? Total bullshit. There is no such thing as risk-free trading. If there were, funds with billions in capital would be doing it 24/7 and closing off access to everyone else.

The Simplest Path to Winning

You could literally flip a coin or have a chicken pick your instrument and direction, and as long as you CLOSE ALL POSITIONS when the loss is at or near your daily risk budget you will remain unf*cked. Just do this ONE THING and you will be well on your way to not losing too much money—which is the only thing that truly matters in the beginning.

Yes, you need a strategy. But most traders would benefit from first learning how to just not lose more than they can mathematically recover from. Until you master that, no strategy will save you.

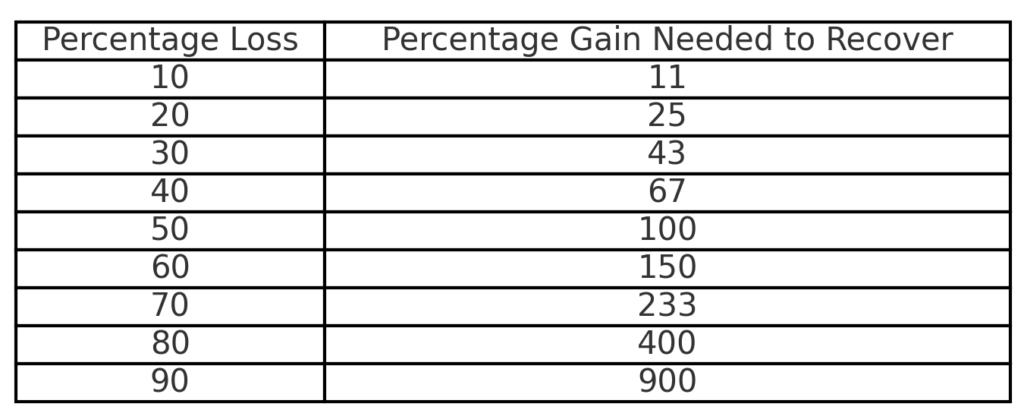

The Math Behind Recovery – This Chart is Everything

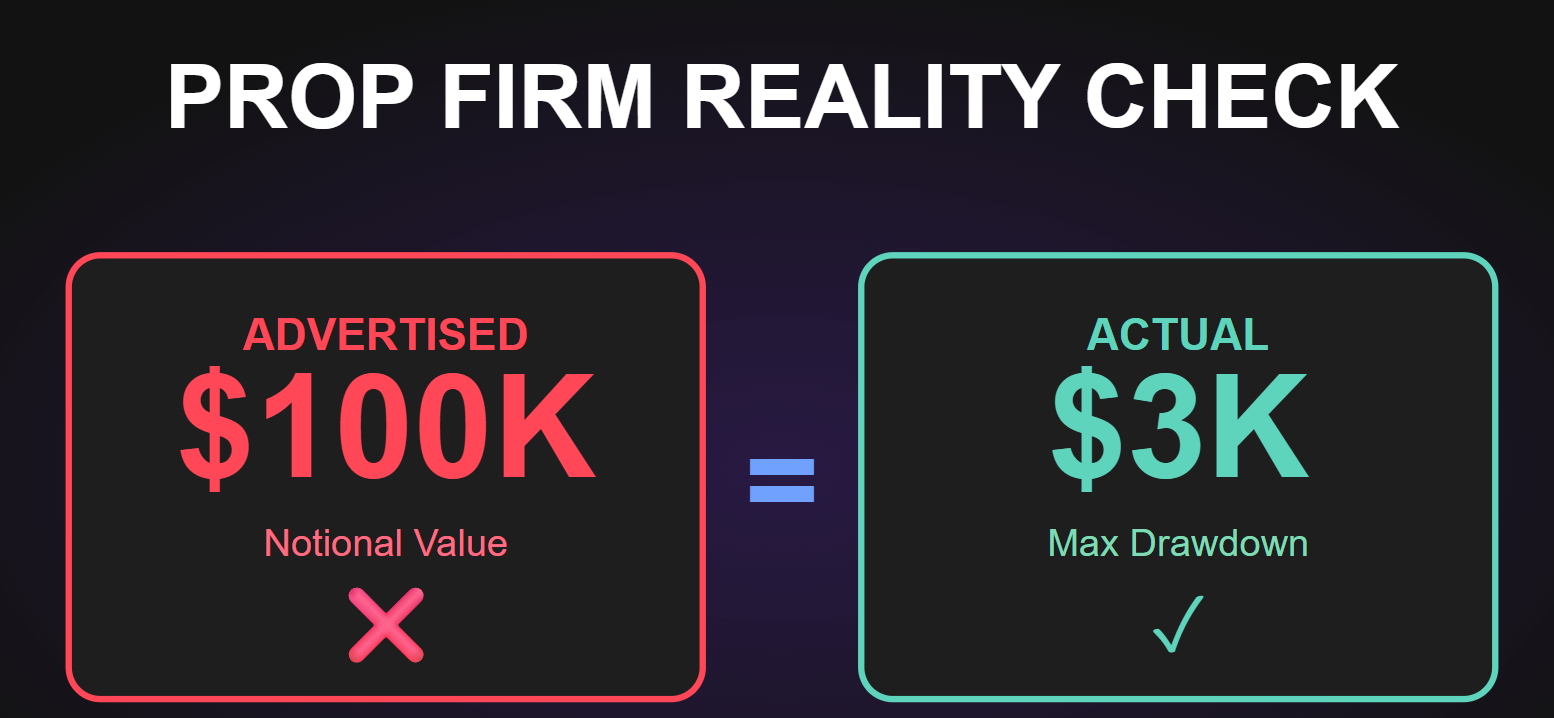

Most traders have probably seen a version of this chart before, but its importance cannot be overstated—especially for prop traders who are dealing with small accounts. In many prop programs, traders treat their entire account as their risk budget, which is a critical mistake. If you lose too much, the math works against you exponentially. A 50% loss doesn’t require a 50% gain to recover—it requires 100%. And if you lose 90%? You need a 900% gain just to get back to even.

This is even more important in prop trading, where you don’t just need to get back to even—you need to stay within a firm’s rules and risk parameters to avoid losing the account entirely. The margin for error is razor-thin, and traders who ignore this reality will churn through accounts indefinitely.

Take a moment and really absorb this table:

This is the brutal truth. Stop treating your entire account as risk capital and focus on staying within a sustainable daily risk budget. That is the only way to give yourself a real shot at long-term success.

This is the brutal truth. Stop treating your entire account as risk capital and focus on staying within a sustainable daily risk budget. That is the only way to give yourself a real shot at long-term success.

So there you have it. That’s how you unf*ck your future(s).

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.