The internet is a wild place, especially when it comes to trading education. Every so often, I come across a review that’s so full of misinformation, irony, and unintentional comedy that it deserves a response—not to argue, but to highlight some actual things traders should look out for when choosing a mentor or trading community.

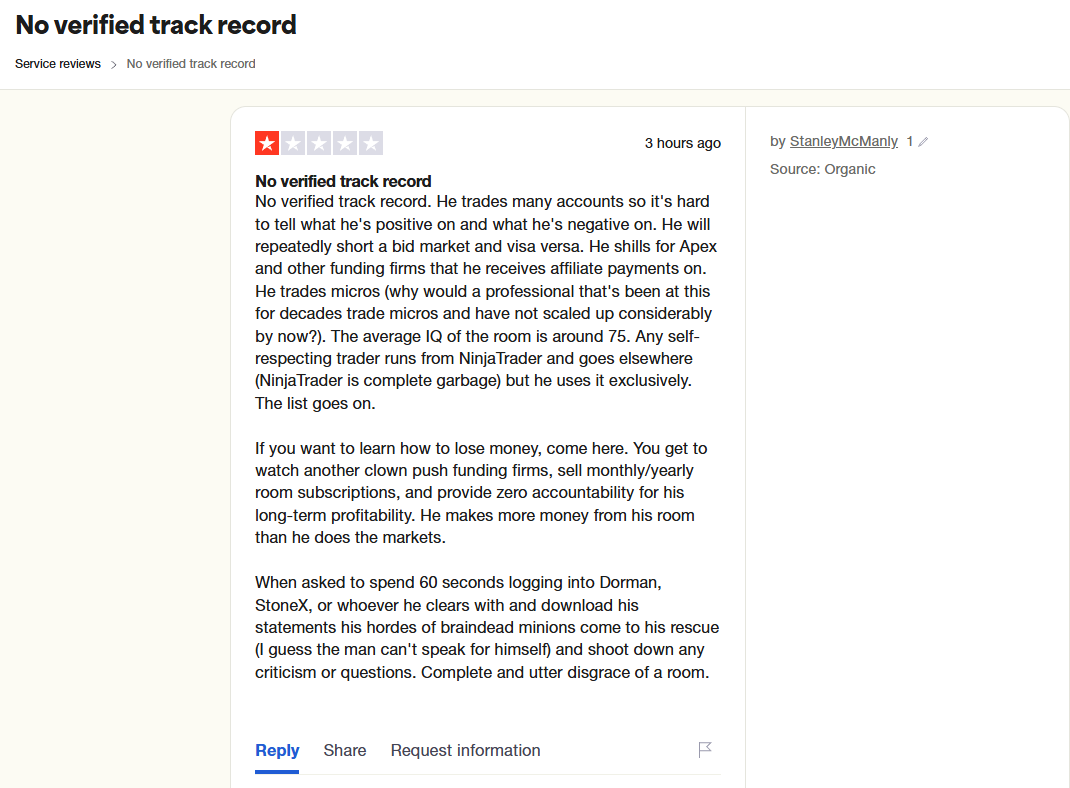

Recently, an anonymous reviewer attempted to post multiple one-star reviews on TrustPilot, only to have them removed (not by me, but likely because anonymous drive-by reviews don’t hold up well). However, before it disappeared, I grabbed a screenshot for reference, which you’ll see below.

Now, I don’t mind criticism—constructive feedback is always welcome. But this review highlights some common misconceptions and talking points that come up again and again in the trading education space. So, instead of just dismissing it, let’s break it down piece by piece and discuss what actually matters when evaluating a trading educator.

For context, the reviews in question were for my ProTrading Room (PTR)—a live, daily trading stream that has 80+ verified 5-star reviews from traders who use their real names. The PTR isn’t some “secret sauce” sales funnel—just a transparent, no-BS place where traders can watch, learn, ask questions, and improve their skills in real time.

So, let’s dig in.

The “Verified Track Record” Obsession

Track records are the holy grail for skeptics. The logic is simple: “Show me the money!” But here’s the problem—track records can be easily manipulated. Want a winning streak? Cherry-pick the best 30 days from the past year. Want to impress? Photoshop works wonders.

The truth is, performance records are a poor metric for evaluating trading education. Why? Because no strategy or educator can guarantee profits. Markets evolve, systems need recalibrating, and success comes down to your understanding and discipline.

My approach? I don’t sell performance. I offer access to my live trade room, where you can see me trade in real time. The value isn’t in my P&L—it’s in the strategies, discussions, and community support.

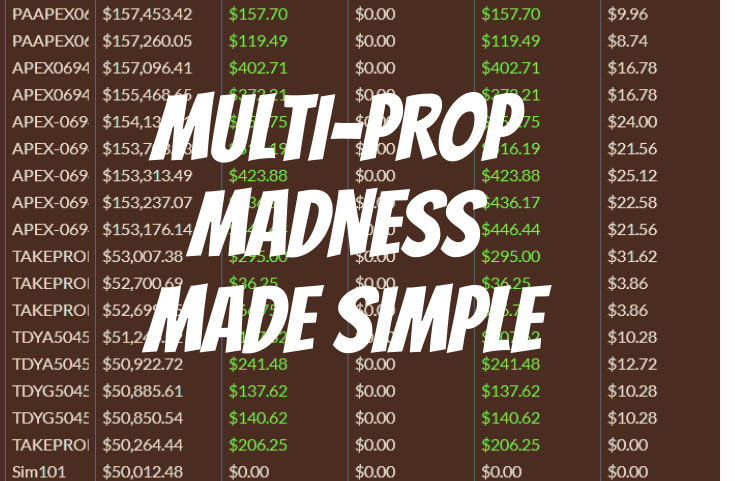

Trading Multiple Accounts Isn’t a Crime

Yes, I trade many accounts. Why? Because it allows me to demonstrate strategies in diverse market conditions. The goal isn’t for members to copy me trade-for-trade—it’s to help them understand the logic behind my decisions.

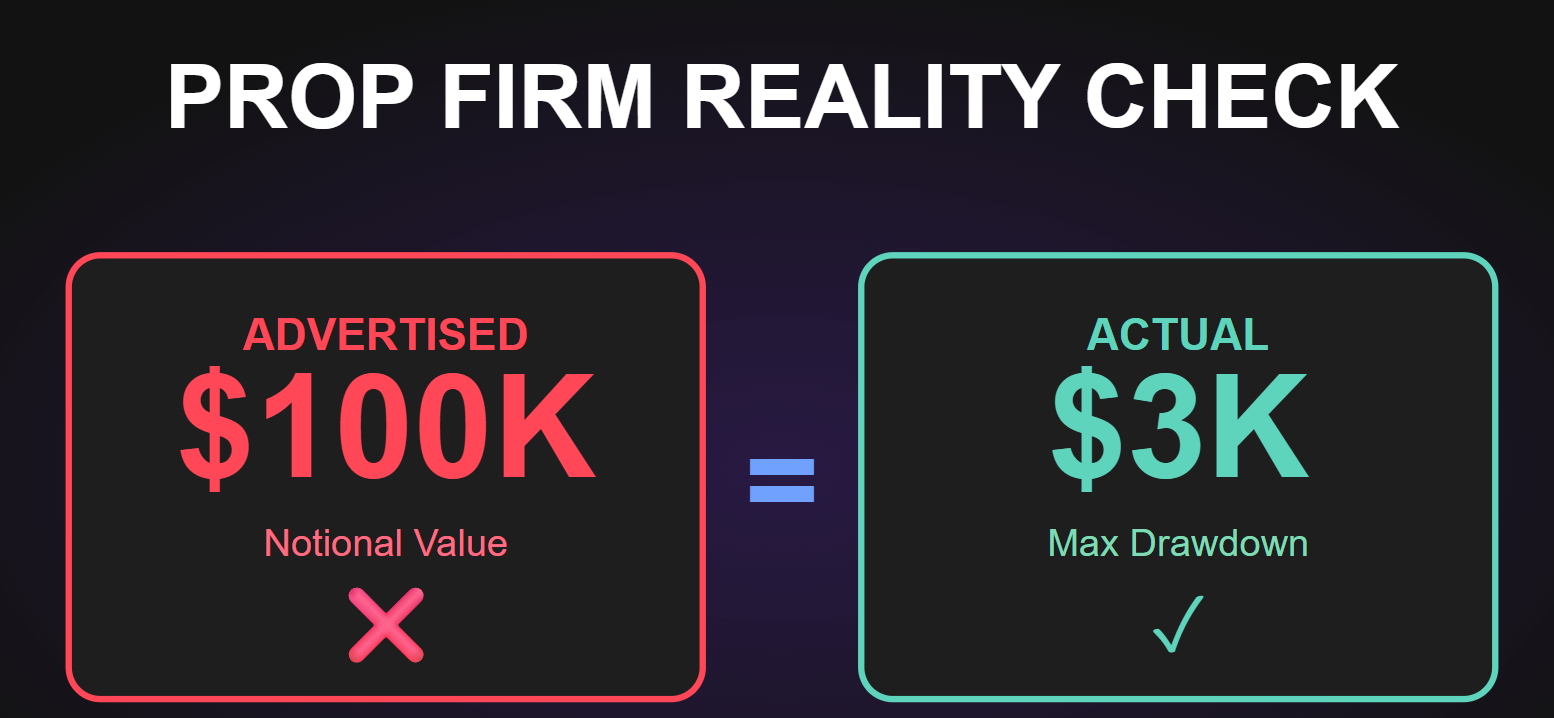

On “Shilling” for Prop Firms

I’m open about promoting prop firms like Apex Trader Funding and Take Profit Trader. Why? Because I believe they offer value—affordable platforms, real-time data, and structured risk management. They’re not perfect, but for disciplined traders, they’re a great stepping stone.

Balancing Long-Term Awareness with Short-Term Action

While we remain flexible in our daily trades, situational fluency calls for considering longer-term downside plays. If signs of froth persist, it makes sense to explore protective strategies like hedging, holding cash, and beginning to sprinkle longer term bearish bets using downside options. But this longer-term thinking should never influence how you trade intraday. Each session is an independent opportunity, and the moment you let bias take over, you lose your edge.

Why Micros Matter

Some argue that a “professional” trader shouldn’t bother with micros. I disagree. Micros allow realistic risk management for smaller accounts, which is where most traders start. My focus is on teaching traders how to grow sustainably, not impressing trolls with flashy trades on larger contracts.

The NinjaTrader Debate

Yes, I use NinjaTrader. No, it’s not “garbage.” It’s one of the most popular retail futures platforms for a reason—it works. End of story.

The Real Problem: Misleading Promises

The reviewer claims I make more money from my trade room than the markets. My response? Lifetime memberships make up the bulk of my community—people who’ve already found value and want to stay.

The bigger issue here is the culture of misleading promises in trading education. If someone is promising guaranteed profits or “magic” strategies, run. Good education focuses on risk management, logic, and realistic expectations.

Final Thoughts

Trolls will troll, but traders should always ask the right questions. Look for educators who:

- Emphasize transparency and risk management.

- Offer realistic examples and tools.

- Avoid flashy promises of easy profits.

In the end, it’s your time and money—spend both wisely.

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.