For most active traders, the world of micro futures is dominated by the big names: MNQ, MES, MYM, and MCL. These popular contracts get the bulk of the attention and volume, particularly the MNQ, which sees more action than nearly any other micro. But there’s a lesser-known group of micros that offer distinct advantages, especially for those managing smaller accounts, trading in quieter markets, or looking for less volatility than the roller-coaster Nasdaq micro provides.

Here’s why you might want to consider these “forgotten micros” as strategic additions to your portfolio:

Lower Volatility, Higher Stability: Unlike the high-octane moves of the MNQ, some of these forgotten micros, like the Micro 10-Year Ultra Bond (MTN), offer a more stable trading environment. This makes them ideal for risk-conscious traders looking to capture consistent trends without being thrown by large price swings.

Diversification Beyond the Big Four: Adding contracts like the Micro Bitcoin (MBT) or the Micro Nikkei (MNK) can give you exposure to entirely different markets, providing natural diversification. It’s a way to explore new opportunities without leaving the futures space you know.

International Market Access: The Micro Nikkei (MNK) offers a new avenue for trading during off-hours in the U.S., along with the Micro DAX. This is especially valuable for non-U.S. traders who want to trade major international indices without being confined to U.S. market hours.

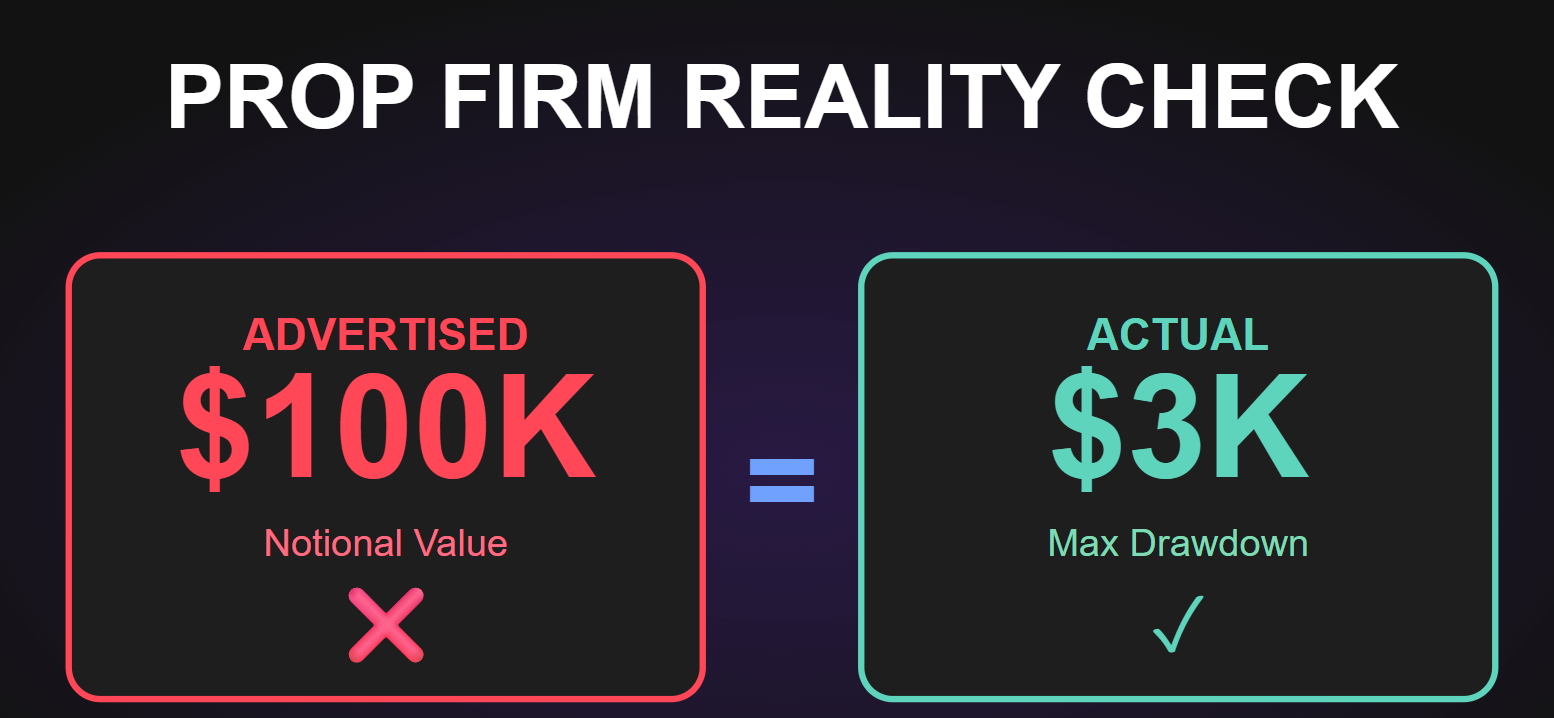

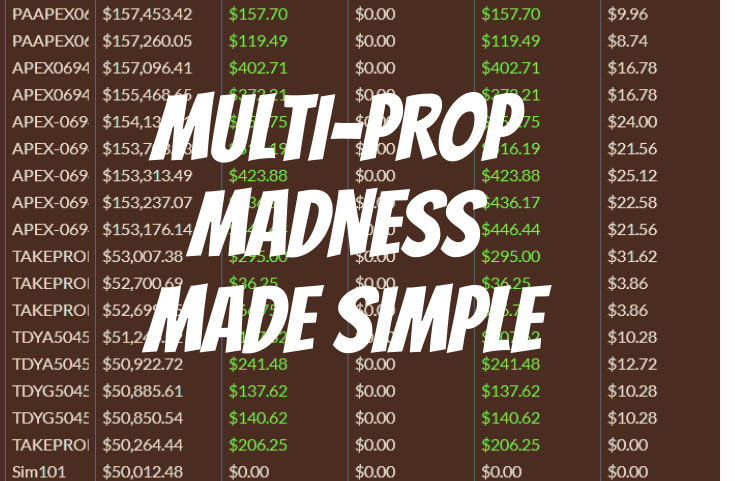

Right-Sized Leverage for Prop Accounts: If you’re trading with a funded account where the max drawdown is limited, the leverage on these micro contracts aligns well with proper risk management. Over-leveraging is a common pitfall in trading funded accounts. The TDG Way emphasizes viewing your drawdown as the real risk capital, meaning a $50,000 account with a $2,500 max drawdown is effectively a $2,500 account. Micro contracts are an ideal choice for this kind of scaled-down, conservative approach.

Spotlight on Three Key “Forgotten Micros”

Now that you know the benefits, let’s dive into a few of these alternative micros that can add new layers to your trading.

1. MTN: Micro 10-Year Ultra Bond

The MTN offers a different profile compared to equities, giving you exposure to the bond market’s stability. With a lower volatility profile than the MNQ, the MTN is an excellent choice for traders looking to hedge or diversify into fixed income trends without excessive risk.

Learn more about MTN from CME Group

2. MBT: Micro Bitcoin Contract

Bitcoin continues to gain prominence, and the MBT contract is a way to access this dynamic market without diving into the large, volatile contracts of full-sized Bitcoin futures. For traders wanting to explore crypto futures without overwhelming exposure, MBT is a perfect fit.

Learn more about MBT from CME Group

3. MNK: Micro Nikkei

The MNK brings the Japanese market to your screen, offering another international index to consider during off-hours alongside the Micro DAX. This can be especially useful for traders outside the U.S. or those looking for opportunities in international markets when the U.S. is closed.

Learn more about MNK from CME Group

A Final Word on Liquidity and Execution

You might wonder about liquidity in these lesser-known micros. Rest assured, the liquidity is more than adequate for retail traders who trade a few contracts per position, especially if you use limit orders. These forgotten micros may be less talked about, but they’re highly functional for those looking to trade with manageable risk.

Try It Out: A Two-Week Trial with Us at PTR

At tradersdevGROUP, we exclusively trade micros, and our team shows daily how these contracts can generate consistent profits with less stress. Want to experience it for yourself? Join our PTR for a free two-week trial and discover firsthand how trading the forgotten micros can help you grow your account in a risk-conscious, profitable way.

Rediscover micro trading—strategically, sustainably, and without the MNQ’s drama.

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.