Many active traders working funding programs face a common challenge: how to grow without taking on unnecessary risk. Trading larger size in a single account can increase pressure and volatility — both in the market and in your mindset. But there’s another way: by connecting and trading multiple prop firm accounts at once, you can scale results while keeping your approach consistent and stress levels low.

In this post, I’ll walk you through what multi-propping is, how to set it up using NinjaTrader, and why it can be a safer and smarter way to scale your trading — without taking on bigger trades or bigger stress.

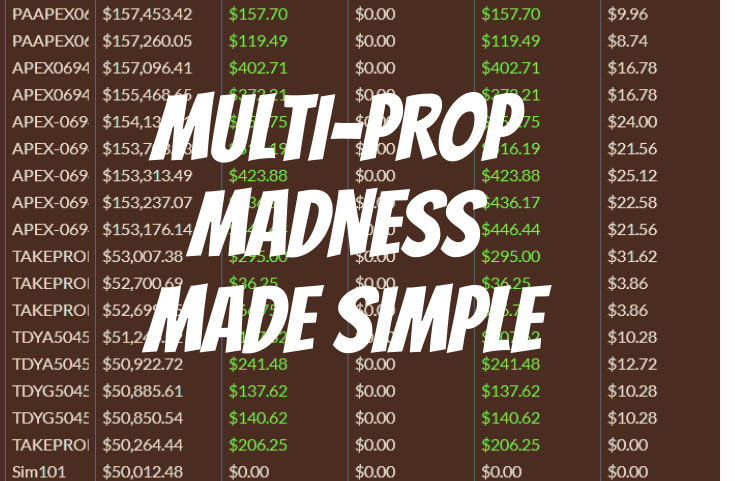

I currently connect to NinjaTrader Brokerage first, then to Interactive Brokers, followed by a rotation of three to four prop firms — typically Apex, Take Profit, MyFunded Futures, TradeDay, and Tradeify. I also maintain funded and evaluation accounts with Bulenox, Funded Futures Network, The Futures Desk, Earn2Trade, and Nexgen Futures. This setup gives me flexibility to run different replication groups and control when and how capital is deployed — all while sticking to one strategy and one size.

What Is Multi-Propping?

Multi-prop trading means connecting multiple evaluation and/or funded prop accounts (from one or more firms) and executing a single trade that gets copied to all of them simultaneously.

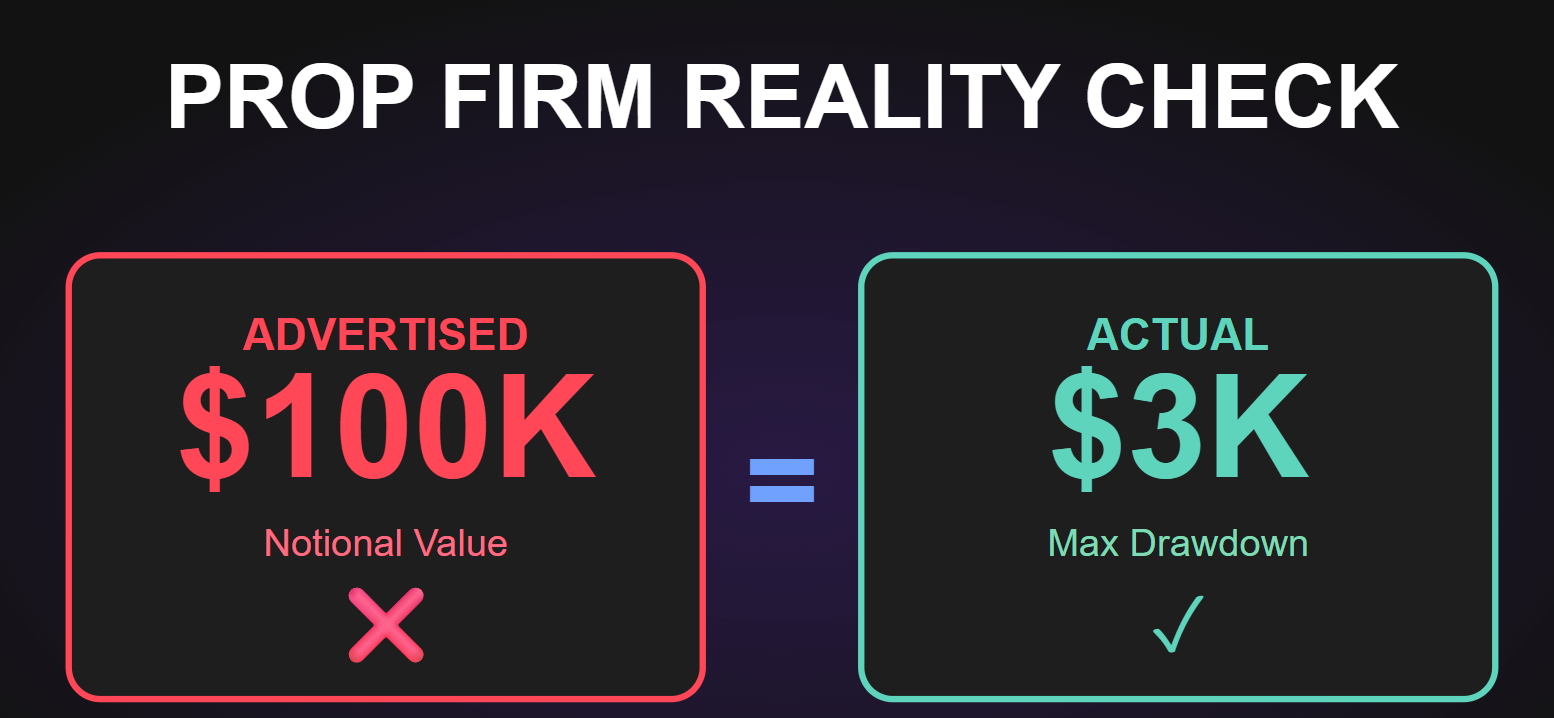

So instead of trading one $50K account and going for a $500 win, you could trade ten $50K accounts, hit a $50 win in each, and end up with the same net result — without needing to size up or stomach bigger swings.

This approach isn’t about chasing more risk. It’s about replicating a small, smart edge across multiple accounts.

What You Need to Get Started

Multi-propping is surprisingly simple when you have the right setup. Here’s what I use:

-

NinjaTrader 8 (latest version)

-

Tradovate-backed funded accounts from firms like:

👉Apex Trader Funding 🎟️ Code: TDGFANATIC

👉Tradeify

👉MyFundedFutures

👉Take Profit Trader 🎟️ Code: TDG

👉TradeDay 🎟️ Code: TDG

👉Legends Trading 🎟️ Code: TDG

👉TickTick Trader

👉Elite Trader Funding

👉TopStep

👉BluSky Trading

👉Purdia Capital

👉Goat Funded Futures

👉Funded Next Futures

👉The Trading Pit

-

Replikanto – a trade copier (more on that in a future post)

-

Live accounts (optional) through NinjaTrader Brokerage or Interactive Brokers

All of these can be part of one replication group. The key requirement? Each prop account must support Tradovate credentials to connect easily to NinjaTrader. Please note that platform support can change, so it’s advisable to confirm with each firm directly for the most current information. Also, you are not able to connect multiple Rithmic data accounts simultaneously. I’ll cover configurations for Rithmic in another post.

How It Works

-

Connect all accounts to NinjaTrader using Tradovate logins.

-

Designate one as your “lead” account.

-

Trade from the chart in that account — entries, exits, stops, scaling.

-

Other accounts (selectively) mirror the trades automatically through the copier.

While many traders run one big replication group, I prefer a more strategic approach.

I use multiple replication groups in NinjaTrader:

-

Evaluation accounts go first — they’re my scouts.

-

These accounts help test the waters early in the session.

-

I watch how the market responds to key levels: are they respected, tested, or broken?

-

-

Live and funded accounts are only added once I’ve confirmed the price action aligns with the strategy.

-

This protects my cash cows — the funded accounts with real payout potential.

-

📸 That’s why you’ll see differences in P&L in the screenshots I post and display in the PTR. Not every account is active from the start, and they may join the group at different moments in the session — but the strategy and sizing never change.

This staggered deployment allows me to participate early without risking my best capital until the edge is confirmed.

Why Multi-Propping Makes Sense

Here’s the biggest takeaway: multi-propping gives you the ability to scale results, not risk.

Instead of pushing size in one account (and stressing over the $500 winner), you’re duplicating a proven, psychologically manageable setup across multiple accounts.

💡 $50 per account across 10 accounts = $500 total

But the emotional experience is completely different.

That makes it ideal for traders following what I call the TDG Way — trading small, building consistency, and compounding confidence.

Rules to Know Before You Start

Each prop firm has its quirks. Here’s what to keep in mind:

-

News trading restrictions – Some firms limit when you can open/close positions around major events.

-

Consistency rules – A few firms penalize large daily PnL spikes or require even trade distribution.

-

No-copy firms – Bulenox, for example, doesn’t allow copying/multi-account setups. But they also don’t support Tradovate, so they don’t need to be in your replication group.

Multi-propping doesn’t mean bending rules. It means trading smarter within each firm’s limits — which you can do confidently when you’re trading 1/20th of their allowed size.

Start Small. Scale Smart.

The most common mistake with multi-propping is doing too much too fast.

Here’s what I recommend:

✅ Start with 2–3 funded accounts from different firms

✅ Trade micros only (MES, MNQ, MYM, etc.)

✅ Same size, same logic across all accounts

✅ Keep management clean — all actions happen in the lead account

Build consistency first. Then scale.

What’s Next

In a follow-up blog post, I’ll break down how to set up your copier (Replikanto), build your replication group in NinjaTrader, and avoid common syncing issues.

Until then, use this guide to get your base setup in place — and test it out with just a couple of accounts.

If you’re already trading futures prop accounts and looking to multiply results without multiplying stress, this may be the most straightforward, scalable edge in the market today.

Commodity Futures Trading Commission. Futures and Options trading has large potential rewards, but also large potential risk. You must be aware of the risks and be willing to accept them in order to invest in the futures and options markets. Don’t trade with money you can’t afford to lose. This is neither a solicitation nor an offer to Buy/Sell futures or options. No representation is being made that any account will or is likely to achieve profits or losses similar to those discussed on this web site. The past performance of any trading system or methodology is not necessarily indicative of future results.

CFTC RULE 4.41 – HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.